Unlock your financial future

Become an accredited investor and discover the path to exclusive investment opportunities and unparalleled financial growth.

Why Become An Accredited Investor?

Unlock the Potential of Private Equity

Dive into the world of Private Equity and seize the opportunity to be part of the transformative journey of high-potential companies. As an accredited investor, you gain exclusive access to investments beyond the reach of public markets, where your capital doesn't just grow — it flourishes.

Maximize Returns with Hedge Funds

Hedge funds offer a dynamic playground. By employing strategies like leverage, short selling, and derivatives, these funds strive to achieve positive returns in all market conditions. Hedge against downturns and capitalize on the flexibility and active management that hedge funds provide.

Venture into the Future with Venture Capital

Step into the forefront of innovation and economic growth with Venture Capital. Back the groundbreaking companies of tomorrow and potentially reap exponential rewards. Get a front-row seat to the latest technologies and market disruptors, offering a unique blend of financial returns.

What is an Accredited Investor?

An accredited investor in the United States must meet SEC financial requirements (SEC).

A two-year average income of $200,000 (or $300,000 jointly).

A net worth of $1 million, either individually or jointly (excluding primary residence).

A Series 7, Series 65, or Series 82 license.

How to Become an Accredited Investor

Being an accredited investor comes with a range of advantages. As an accredited investor, you have the opportunity to participate in private placements, hedge funds and venture capital contributions, which are exclusive investment opportunities not available to the general public. These investments often offer higher potential returns and access to unique asset classes.

Becoming an accredited investor requires meeting the income and net worth thresholds mentioned above, set by the SEC or licensing qualifications. While the requirements may vary, they are designed to ensure that accredited investors have the financial means and knowledge to understand and bear the risks associated with certain investment opportunities.

While reaching the individual requirements of a two-year average income of $200,000 and a net worth of $1 million or more (not including primary residence) can be a difficult and time consuming accomplishment, there is the alternative requirement of having a financial license.

The Series 7 and Series 82 licenses require a FINRA sponsor, which would be difficult to come by if you are not employed by a financial institution. However, the Series 65 license, Uniform Investment Adviser Law Exam, can be taken without a sponsor, meaning that anyone that passes the exam will receive a Series 65 license and qualify as an accredited investor.

The Series 65 Exam

The Series 65 is the Uniform Investment Adviser Law Exam. Successfully completing the exam rewards a Series 65 license, and a qualification as an accredited investor. The exam consists of 130 questions and candidates must answer at least 92 questions correctly to pass. Candidates have 180 minutes to complete the exam and it costs $187 to register. This may be an efficient alternative to the time intensive income and net worth requirements, for those looking to become an accredited investor more quickly.

Questions

Duration

Cost

Outsized Potential

Build your financial empire on the same principles that guided visionaries to turn their foresight into immense wealth. Unlock the same investment avenues that renowned accredited investors utilized to carve out remarkable success stories by tapping into extraordinary opportunities through private equity, hedge funds and venture capital.

Known as the "Oracle of Omaha," Warren Buffett's investment savvy has made him one of the wealthiest and most respected businessmen in the world. His approach to investing, focusing on long-term value and potential, showcases the profound impact of strategic investment decisions.

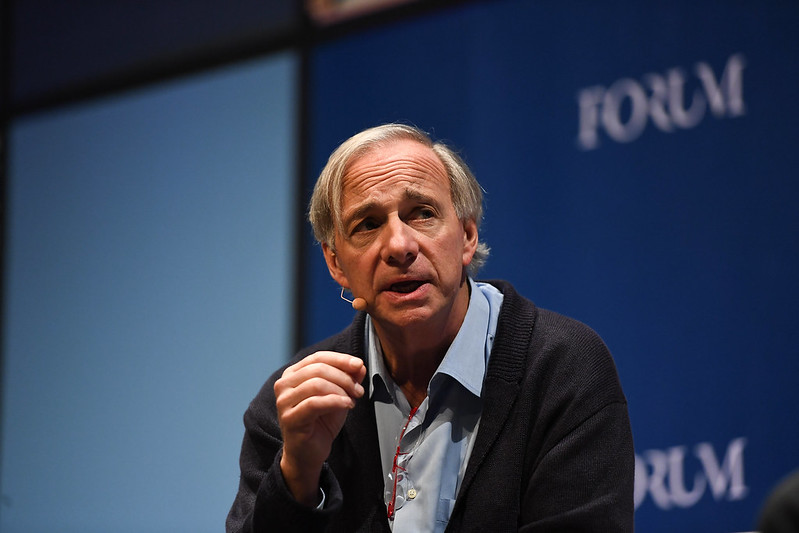

Founder of Bridgewater Associates, the world's largest hedge fund, Ray Dalio is renowned for his unique approach to investment and economic insights. His success in hedge fund management demonstrates the sophisticated strategies and risk management techniques that can lead to substantial returns.

As an innovative software engineer turned prolific venture capitalist, Marc Andreessen has been behind some of the most significant tech investments of the past two decades, including Facebook, Twitter, and Airbnb. His success highlights the impact of venture capital in driving technological advancement and market disruption.

A co-founder of PayPal and an early investor in Facebook, Peter Thiel's knack for recognizing potential in startups has made him a legendary figure in venture capital circles. His investments underscore the transformative potential of venture capital in shaping the future of technology and business.

Discover the Path to Accreditation

Follow financial giants and learn how to become an accredited investor regardless of your current income or network. One test can unlock exclusive investment opportunities and path toward a brighter future.

Get Started Today

Once you're ready to get started, consider study materials from Kaplan. They offer a Question Bank of practice questions to help truly prepare for the exam.

Ready for the Exam?

Find more details about the exam and how to register on the FINRA website. Only one test could stand between you and a brighter investing future.